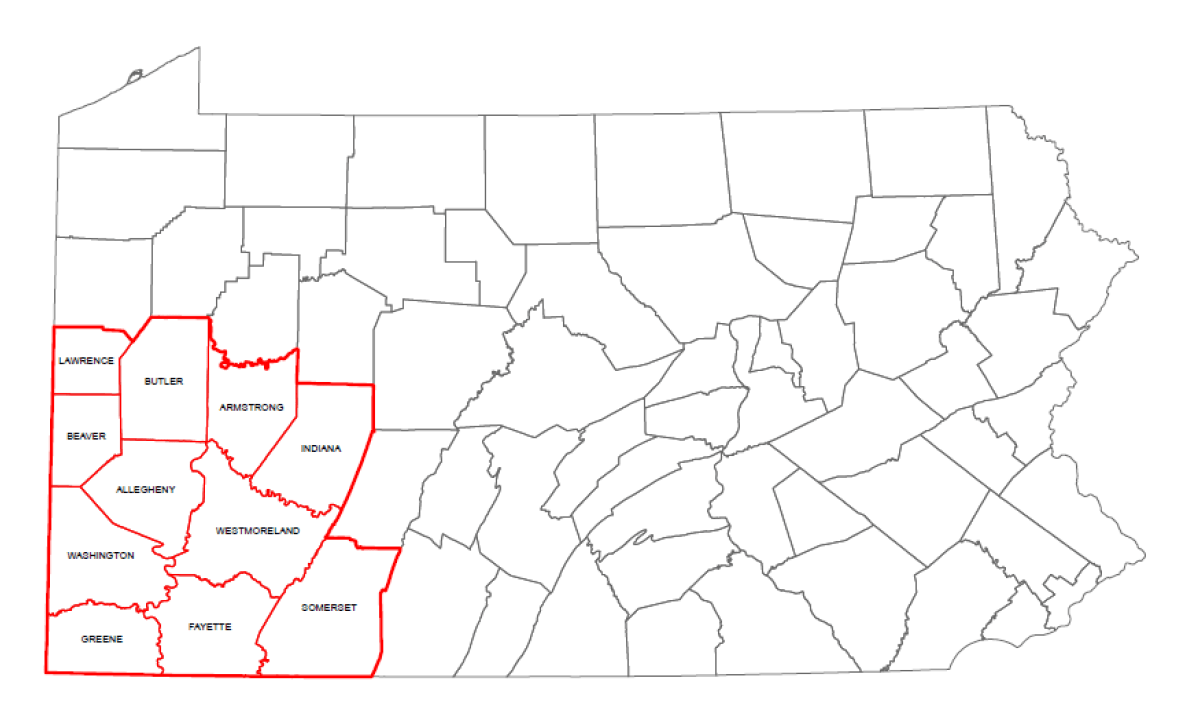

Federal Trade Zone #33

Unlock Your Global Advantage with Foreign Trade Zone #33

FTZ #33 offers businesses throughout southwestern Pennsylvania a powerful incentive to compete and grow in today’s global economy. As part of the U.S. Foreign Trade Zone program, FTZ #33 provides manufacturers, distributors and logistics companies the strategic benefits that reduce costs, streamline operations and improve global competitiveness.

Why FTZ #33?

Located in a region with robust multimodal transportation – including access to rail, river, highway and air – FTZ #33 supports a diverse range of industries, from advanced manufacturing and energy to life sciences and logistics.

FTZ #33 offers cost savings and flexibility benefits including:

FAQs

What is a Foreign Trade Zone?

What are the advantages of using a Foreign Trade Zone?

• Duties and taxes apply only when goods enter U.S. commerce.

• Goods can be exported from the zone without duty or tax. Merchandise may stay in a zone indefinitely and benefit from CBP protection against theft.

• Duty rates may vary based on zone operations, allowing users to choose the lower rate – on either raw materials or finished goods.

• Items imported under bond may enter a zone to meet federal or state export requirements, including those under the Tariff Act of 1930 or similar laws.

Who can use a Foreign Trade Zone?

Who oversees FTZ #33?

Can airlines or handling agents operate their own FTZ site?

Can air cargo be moved directly into FTZ #33 from aircraft?

Is an FTZ right for my operations?

Things to consider when applying for an FTZ:

• Do you have a high volume of entries into the US?

• Do you have large Customs duty payments?

• Have you experienced delays in receiving shipments through Customs?

• Do you pay more than $485 in weekly entry fees?

• Do you apply for duty drawback?

• Do you scrap, waste, destroy or reject some of your imports?

• Costs to consider in your evaluation:

o FTZ Board Fees

o Grantee Fees

o Consultant Fees

o Operator’s Bond Fee

o Security

o Software

o Training

How can I apply for FTZ designation?

Interested companies can apply for FTZ #33 designation through [email protected] and work with U.S. Customs and Border Protection for approval.

How can I learn more about FTZ #33?

For additional information, contact Jeni Cooper at 412-315-6442 or [email protected]